Portfolio Loans Gaining Popularity

Inflation has been the hot topic in the economy, and the Fed has taken action in an attempt to reel it in to more acceptable levels. This has caused mortgage rates to increase .75% between mid-December and mid-January. In a separate action, the Federal Housing Finance Authority “FHFA” that regulates Fannie Mae and Freddie Mac announced they’re imposing charges to high balance loans and loans made on 2nd homes. The justification of the charges by FHFA is to use the funds to expand products to increase homeownership and affordable housing. While the timing is unfortunate, the Fed’s actions and FHFA’s announcement are not necessarily related.

The FHFA fees will be incurred for loans purchased after April 1st 2022, which means that most lenders will need to impose the fees to borrowers for loans funding after March 14th. The 2 week time difference is the estimated length of time it takes for a lender to package and sell the loan to Fannie Mae or Freddie Mac. Evaluating what the price increases mean in terms of interest rate increases, it appears that 2nd homes will be receiving terms in line with rental properties when they previously mirrored owner occupied terms. For high balance loans the rate increase is anywhere from .125-.375% depending on the loan-to-value, or down payment for home buyers. High balance loans are Conventional mortgages between $647,201-970,800 for high cost Counties such as Orange and Los Angeles, that are sold to Fannie Mae or Freddie Mac, and meet their underwriting criteria.

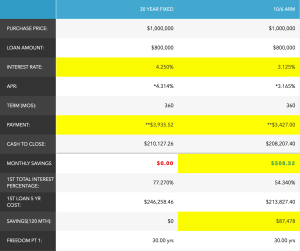

Portfolio loans are made by lenders and are either retained or sold to a financial institution, and are not sold to Fannie or Freddie. In many current cases the terms provided are more cost effective than a conventional loan. This is especially true for terms on 2nd homes. For instance, a Portfolio 10/6 ARM used to be around .25% lower in rate compared to a high balance conventional 30 Year Fixed, we’re now seeing it around 1% less. For most, .25% was not enticing enough to take a 10/6 ARM, but 1% less in rate makes it far more appealing. Below is an example of a high balance 30 Year Fixed vs. a 10/6 portfolio ARM. Payment shown is Principle and Interest, taxes and insurance are not included in the payment.

If you need assistance with a purchase or refinance, I can be reached at (949) 238-6035. Or you can start the process online at: www.mattcadymortgageteam.com